Advertisement

Puerto Rico authorizes debt payment suspension; Obama signs rescue bill

By Nick Brown

SAN JUAN (Reuters) – Puerto Rico authorized suspension of payments on its general obligation debt on Thursday just minutes after U.S. President Barack Obama signed a law creating a federal oversight board with authority to negotiate the restructuring of the island’s $70 billion in debt.

The executive order issued by Puerto Rico’s governor, Alejandro Garcia Padilla, comes just one day before the U.S. territory was due to make $1.9 billion worth of debt payments on July 1, including some $780 million in constitutionally-backed, general obligation bonds.

It remains to be seen whether Puerto Rico will pay part of the GO debt or any of the non-GO debt.

“Under these circumstances, these executive orders protect the limited resources available to the agencies listed in these orders and prevents that these can be seized by creditors, leaving Puerto Ricans without basic services,” Garcia Padilla’s administration said in a statement.

The flurry of activity represents the nadir of a decade-long struggle by Puerto Rico, home to 3.5 million Americans, to stave off economic collapse, reverse a 45 percent poverty rate and stem rampant emigration that exacerbates the economy’s decline.

Garcia Padilla authorized the suspension of general obligation payments under a previously enacted local debt moratorium law that has already been challenged by a creditor lawsuit filed in U.S. District Court in Manhattan.

In addition, Garcia Padilla also declared states of emergency at the island’s biggest public pension – the Commonwealth’s Employee Retirement System – which is more than 99 percent underfunded, as well as the University of Puerto Rico and other agencies.

Puerto Rico’s benchmark 2035 General Obligation bond rose 0.44 points in price to trade at 67.19 points, pushing the yield down to 12.578 percent.

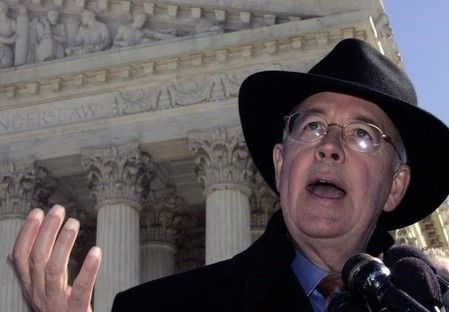

OBAMA SIGNS PROMESA

In Washington, Obama signed the Puerto Rico Oversight, Management and Economic Stability Act, or PROMESA, in the Oval office on Thursday, one of the few pieces of bi-partisan legislation to make it to his desk.

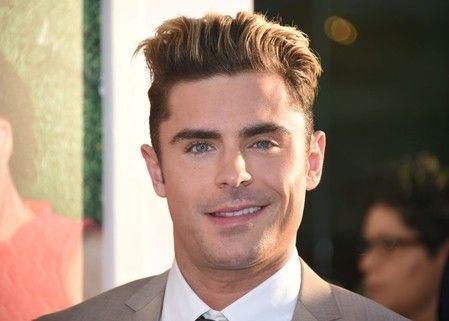

“I want to let the people of Puerto Rico know that although there are still some tough work that we’re going to have to do to dig Puerto Rico out of the hole that it’s in, this indicates how committed my administration is to making sure that they get the help they need,” Obama told reporters before signing it.

The law will allow the island access to a bankruptcy-like debt restructuring process, but put its finances under the control of a federally-appointed board — a condition that has riled many in Puerto Rico, including Garcia Padilla.

PROMESA, which passed the U.S. Senate on Wednesday, puts a stay, or halt, on litigation in the event of a default. Puerto Rico has already defaulted three times on portions of its debt in the last year.

The stay is critical to keep Puerto Rico’s financial restructuring from devolving into a mess of long, costly court battles. The stay is retroactive back to December 2015.

The oversight board will have the authority to facilitate consensual restructuring talks, or push Puerto Rico into a court-supervised process akin to U.S. bankruptcy. It will also oversee and monitor the implementation of sustainable budgets.

Still, missed payments matter for the insurers who have to pay out on claims should Puerto Rico not deliver the cash to its investors.

MBIA’s National Public Finance Guarantee insures about $173 million in GO debt due on Friday, while Assured Guaranty covers another $184 million, and Ambac insures $40 million in GO or GO-guaranteed debt due on Friday.

The island’s debt-laden semi-public power utility, PREPA, earlier on Thursday announced it will make its full, $415 million payment due Friday, under the terms of a restructuring agreement reached late last year with the bulk of its creditors.

PREPA, which had been on the brink of collapse under $8.3 billion in debt, last year reached an exchange deal with most of its creditors, which is being finalized. The payment will be made using operational funds and proceeds from new bond sales.

“Today’s outcome is another step towards PREPA’s transformation,” Lisa Donahue, the utility’s chief restructuring officer, said in a statement.

(Reporting by Nick Brown; Additional reporting by Roberta Rampton in Washington; Editing by Daniel Bases and Bernard Orr)