Advertisement

Airports go slow on Delta’s plans to expand VIP security lanes

By Jeffrey Dastin

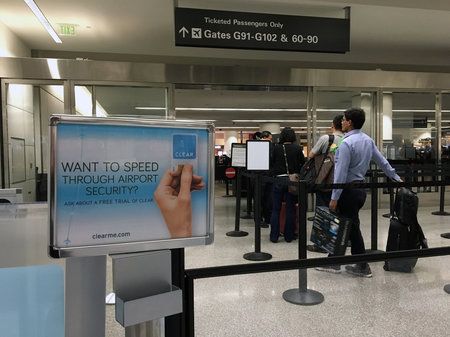

NEW YORK (Reuters) – As travelers face long waits for U.S. airport security checks, Delta Air Lines Inc wants to expand limited access lanes to allow its top fliers – and anyone who pays a fee – to jump to the front of the line.

But some airport managers are balking at the idea, saying they don’t have the room or don’t want to do anything that may compound delays for regular fliers. Houston’s two main airports plan to drop the program next year.

Eleven other airports have the expedited lanes operated by CLEAR, a private company. For $179 a year, CLEAR checks users’ identities and links them to iris scans and fingerprints.

At the airports, CLEAR employees verify customers’ identities and escort them to the U.S. Transportation Security Administration (TSA) screening area – bypassing other travelers.

Delta, which bought a 5 percent stake in CLEAR in April, wants the service to expand into its U.S. hubs. Delta also plans to discount CLEAR for frequent fliers and make it free for customers who spend $15,000 and accrue 125,000 miles in a year.

The No. 2 U.S. airline in passenger traffic said it wants to increase the use of CLEAR because “customers tell us their time is valuable.”

But representatives of several airports told Reuters they had concerns about adding or expanding the service.

An official with Houston’s Bush and Hobby airports said CLEAR lanes were little used – frustrating other travelers waiting in line.

‘LIKE PLATINUM’

At a time when travelers scour websites for bargain airfares, Delta is trying to stand out as a high-end brand with unique services and infrequent flight cancellations. Chief Executive Ed Bastian said he believes the strategy will allow the airline to command higher prices.

“Our product is not a commodity,” Bastian told analysts on an April conference call.

CLEAR has succeeded in some places. At California’s San Jose International Airport – where 100 to 300 people use CLEAR lanes each day, compared to 17,000 or more in the regular lines – it’s a hit with technology executives, said the airport’s Deputy Director of Airport Operations Bob Lockhart.

In Orlando, where CLEAR first opened, the program has its own entry into security.

“There was a joke in Orlando that a CLEAR card was flashed like Platinum American Express,” said Carolyn Fennell, spokeswoman for the Greater Orlando Aviation Authority.

But Charlie Leocha, chairman of consumer advocacy group Travelers United, said it was “a shame that regular travelers get to be treated as second-class citizens.”

Long lines have been a frustration to frequent travelers like Matt Adams, 33, who flew through San Francisco International Airport earlier this week. Some lanes “are not really managed effectively, while others are backed up,” said the software analyst departing San Francisco for New York.

David Cohen, CLEAR’s Chief Administrative Officer, bristled at the notion that the service was elitist. Anybody can buy it, and CLEAR offers promotional rates for first-time users, he said.

“The CLEAR lane from our perspective is not unlike that toll road that anyone has an opportunity to use,” Cohen said.

JAMMED AIRPORTS

Acute security delays at airports this spring have been blamed on a good economy and bad planning.

It began when the TSA opened applications for its own expedited security program, PreCheck, in 2013. For $85 every five years, pre-screened travelers keep their shoes on and laptops stowed, moving through security checks three times as fast.

The TSA aimed for 25 million people to sign up for pre-vetting and cut agents accordingly. As it turned out, about 10 million travelers have enrolled. On top of that, screening lapses prompted the agency to reduce its practice of pulling fliers from long security lines into under-used PreCheck lanes. As a result, the TSA has not realized the staffing efficiency it expected.

In addition, travel has surged as the economy recovered. This year, the TSA projects it will screen 15 percent more people than in 2013, with 12 percent fewer agents. (Graphic: http://tmsnrt.rs/1sMaHZu)

Amid the outcry over the ensuing bottlenecks, the TSA replaced Kelly Hoggan, head of its Security Operations Office, and it won funding to hire 768 more agents. The TSA is hoping to contract more vendors to enroll people in PreCheck – an opportunity CLEAR is interested in, Cohen said.

Airlines also are responding. Delta, American Airlines Group Inc and United Continental Holdings Inc are each adding $4 million to what they typically spend on workers to help TSA agents with non-screening tasks, such as restocking bins.

Any new CLEAR lanes must be approved by airport managers, airlines that share a terminal and the TSA. Several managers said they weren’t interested – at least for now.

“We just don’t have room,” said Peter Higgins, director of airport operations at Delta’s Salt Lake City hub.

But, a spokeswoman added later, the airport is looking at its options.

CLEAR plans to expand in coming months, Cohen said.

It has approached Los Angeles, a focus city for Delta, according to a source familiar with the matter. But airport managers there have yet to be convinced that demand for the service merits the space, the source said.

Los Angeles World Airports declined to comment.

Managers of Delta’s Seattle hub hope to have a contract with CLEAR soon, according to a spokesman. At its Minneapolis hub, talks are ongoing.

“We’re not quite ready yet to sign on the dotted line,” said Patrick Hogan, a spokesman for the airports commission in Minneapolis. “We don’t want to add a CLEAR line that then squeezes out someone else.”

(Reporting By Jeffrey Dastin in New York; Editing by Joseph White and Lisa Girion)