Advertisement

Paramount stake sale could hamper deal for Viacom: National Amusements

By Jessica Toonkel

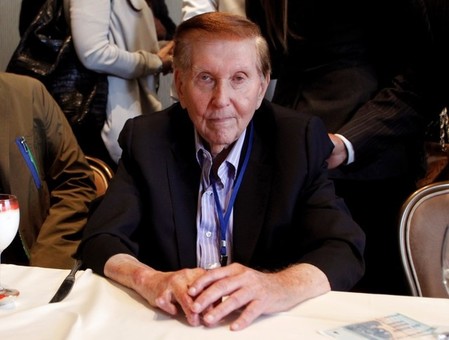

(Reuters) – Sumner Redstone’s privately held movie theater company said on Friday it opposes the sale of a minority stake in Viacom Inc’s Paramount Pictures, because such a transaction could hurt the chances of a deal involving all of Viacom.

National Amusements Inc, through which the 93-year-old media mogul owns 80 percent of Viacom, said in a statement that Paramount was “one of Viacom’s most valuable assets” and a stake sale “would chill the interest of parties that may be interested in a larger transaction involving all of Viacom.”

Redstone also owns 80 percent of the voting shares of CBS Corp through National Amusements. Viacom split off from CBS in 2006, but many investors have said they hope the two will merge again.

CBS Chief Executive Les Moonves, whom some expect would be tapped to head the combined company if that merger were to happen, is said to be interested in owning a movie studio, according to sources familiar with the situation. CBS declined to comment.

A Viacom spokesman said it was “beyond understanding” that National Amusements would continue to interfere with a potential Paramount deal that would create a long-term value “without even waiting for the facts.”

The statement comes two days after Reuters was first to report that Dalian Wanda Group is interested in buying the Paramount stake.

Wanda’s interest adds urgency to deliberations over Paramount’s future, which has become the flashpoint of a bitter feud between Viacom Chief Executive Philippe Dauman and Redstone, the company’s controlling shareholder. Redstone has so far opposed the sale, which is not possible without his consent.

Last month, National Amusements moved to replace Dauman and four other directors on Viacom’s board, an action that is being contested in a Delaware court.

In its statement Friday, National Amusements said that the five directors it has elected to replace the sitting ones should be able to review the proposed transaction. Under an order by that court, Viacom would have to give National Amusements five days notice before entering into a deal for Paramount.

“If the new board decides to pursue a sale of a minority stake in Paramount as part of a larger strategic plan for Viacom, we are confident that a buyer could then be identified and a sale consummated,” National Amusements said.

In June, National Amusements changed Viacom’s bylaws to require unanimous board approval of any stake sale, meaning Sumner Redstone and his daughter, Shari Redstone, would have to agree to the deal.

When Dauman announced in February that he was exploring selling a minority stake in Paramount, Viacom’s stock rose as much as 7 percent.

And many analysts have continued to praise the idea of a sale in recent weeks.

But some investors have grown increasingly hopeful that a bigger deal involving all of Viacom might be in the works.

“I want to see the whole company get sold so why complicate it by selling half of Paramount to someone else,” Salvatore Muoio, whose firm, S. Muoio & Co LLC, is one of biggest owners of voting shares of Viacom.

(Reporting by Jessica Toonkel; Editing by Nick Zieminski and Steve Orlofsky)