Advertisement

Exclusive: Accidental mogul – China property billionaire’s route to Hollywood

By Matthew Miller and Shu Zhang

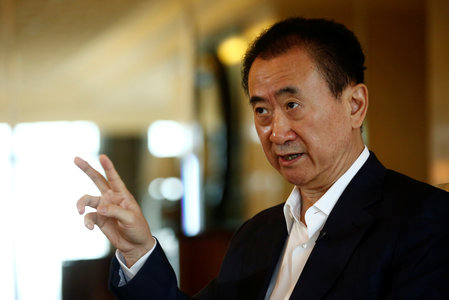

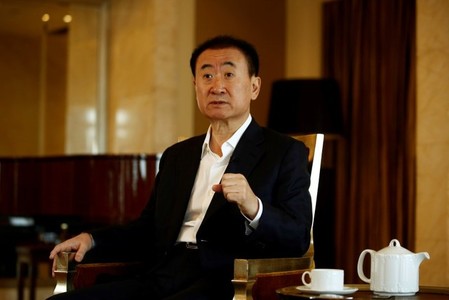

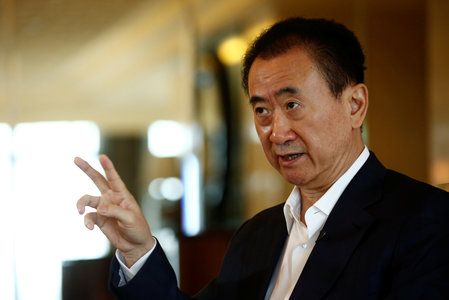

BEIJING (Reuters) – Wang Jianlin, the billionaire Chinese property tycoon turned entertainment mogul, says his push into movies was entirely accidental.

“We didn’t have a choice, we were forced into it,” Wang, whose Dalian Wanda Group controls Hollywood studio Legendary Pictures and U.S. cinema chain AMC Entertainment Holdings <AMC.N>, told Reuters in an exclusive interview this week.

In 2006, Dalian Wanda Group was looking for a partner to operate movie theaters at the massive shopping malls it was building around the country.

Wang first turned to Time Warner <TWX.N>, but the U.S. media giant was forced to quit China because of foreign ownership restrictions. Shanghai Media Group, a state-owned conglomerate, abandoned a separate deal.

Today, Wanda is not only the world’s biggest commercial property developer, with 149 signature Wanda Plazas in China, but also the largest cinema operator, controlling more than 13,000 screens on four continents once current deals are closed.

The acquisition in January of Legendary, co-producer of hits such as “Jurassic World” and “The Dark Knight”, was the biggest U.S.-China movie deal to date and a step toward the Dalian Wanda chairman’s ambition of becoming a major Hollywood player.

“Shanghai Media Group must really regret that they gave up such a good company that would have cost so little,” said Wang, a former People’s Liberation Army staff officer who took over a local construction firm 28 years ago and borrowed 1 million yuan to start building residential housing.

STUDIO AMBITIONS

Revenue from Wanda’s cultural division, which also includes a rapidly growing tourism business, theme parks and sports, is expected grow at least 30 percent this year, and may reach 70 billion yuan ($10.5 billion), Wang said.

Wanda aims to more than double that to 150 billion yuan by 2020, a target Wang says may be reached early.

The company owns a stake in leading Spanish soccer club Atletico Madrid and Swiss sports marketing firm Infront Sports & Media AG, and is keen to add more sports events to its portfolio.

“The speed, particularly in these 3 or 4 years, has been beyond my expectation. It hadn’t crossed my mind that consumer demand for entertainment, sports and tourism could be as strong even as China’s economy slows,” Wang told Reuters.

“If we maintain growth like this, I believe that Wanda will rank among the top three or top five entertainment companies in the world.”

Box office revenue in China reached 44 billion yuan in 2015 and is projected to surpass the United States by the end of next year.

“Wang is riding the intersection of a few trends and playing it well,” said Willy Shih, professor of management practice at Harvard Business School, who has written about Wang and his film ambitions.

Nowhere are those ambitions better reflected than at Wanda’s Qingdao Oriental Movie Metropolis, an $8 billion movie studio, theme park and real estate development scheduled to launch in April 2018.

The studio will attract at least five films a year with production budgets of more than $100 million, alongside smaller Chinese productions, Wang said.

It should also provide a vehicle for Hollywood and other film producers to get around tight Chinese import restrictions and get access to the China market, said Harvard’s Shih.

A total of 34 foreign films are allowed into China each year under a revenue-sharing model that gives 25 percent of box office receipts to foreign movie studios. Fourteen must be in “high-tech” formats such as 3D or IMAX.

Wang is even getting China Eastern Airlines <600115.SS> to launch a daily flight between Los Angeles and Qingdao, while subsidies will be offered to further entice producers to use Qingdao’s planned 50 sound stages.

“That’s my ace in the hole,” he said.

BOLD BUYS

Wanda’s global entertainment buying spree isn’t likely to slow down anytime soon.

Wang said he was looking to announce two billion-dollar non-production film-related deals in the United States.

He is also setting his sights on making a bid for one of Hollywood’s “Big Six” studios, with Paramount Pictures a possible target, while preparing to start movie co-investment next year.

Wang admitted that not everything he tries succeeds. In July, Wanda announced that it was closing for renovation its movie theme park in Wuhan, central China, part of a tourism and shopping development launched in 2014. Visitor numbers at the park had dwindled in recent months.

“This is a learning process,” said Wang, who has made it clear he intends to challenge Disney <DIS.N> and other western theme park developers.

“We are newcomers to this business, and there are no reference points,” he said. “Wanda is absolutely on its own, so we’re making changes as we go along. This is the price of entry. We haven’t seen a big real estate company successful transform into a services or culture enterprise.”

But China’s richest man says he can afford failure.

“If we buy one of the Big Six (movie studios), for $5 or $8 billion, and lose it all, Wanda wouldn’t go bankrupt,” Wang said.

“Without boldness, there will be no success,” Wang said earlier.

(Reporting By Matthew Miller and Shu Zhang; Editing by Alex Richardson)