Advertisement

Illinois governor’s office warns of crippling pension payment hike

By Dave McKinney and Karen Pierog

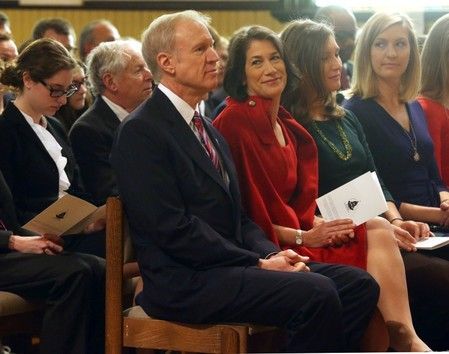

CHICAGO (Reuters) – Potential action this week by Illinois’ biggest public pension fund could put a big dent in the state’s already fragile finances, Governor Bruce Rauner’s administration warned.

A Monday memo from a top Rauner aide said the Teachers’ Retirement System (TRS) board could decide at its meeting this week to lower the assumed investment return rate, a move that would automatically boost Illinois’ annual pension payment.

“If the (TRS) board were to approve a lower assumed rate of return taxpayers will be automatically and immediately on the hook for potentially hundreds of millions of dollars in higher taxes or reduced services,” Michael Mahoney, Rauner’s senior advisor for revenue and pensions, wrote to the governor’s chief of staff, Richard Goldberg.

When TRS lowered the investment return rate to 7.5 percent from 8 percent in 2014 the state’s pension payment increased by more than $200 million, according to the memo.

Illinois’ fiscal 2017 pension payment to its five retirement systems was estimated at $7.9 billion, up from $7.617 billion in fiscal 2016 and $6.9 billion in fiscal 2015, according to a March report by a bipartisan legislative commission.

The country’s fifth-largest state’s unfunded pension liability stood at $111 billion at the end of fiscal 2015, with TRS accounting for more than 55 percent of that gap. The funded ratio was a weak 41.9 percent.

An impasse between the Republican governor and Democrats who control the legislature left Illinois as the only state without a complete 2016 budget. A six-month fiscal 2017 spending plan was passed in June.

Mahoney cautioned that “unforeseen and unknown automatic cost increases would have a devastating impact” on Illinois’ ability to fund social services and education.

One of Rauner’s top Republican legislative allies, Senate Minority Leader Christine Radogno, urged the TRS board to delay a vote Friday to give the public time to weigh in on its possible actions.

“This issue is important enough at the very least to put the TRS board on notice we don’t want them taking any action that could cost taxpayers $200 to $300 million without appropriate scrutiny,” she said.

TRS spokesman Dave Urbanek said the pension system was not aware of Mahoney’s memo until Tuesday and that Rauner’s office had requested “information about the scenarios under consideration.”

He added TRS did not offer “potential scenarios” either to the governor’s office or legislative leaders and noted the TRS board has not yet discussed the matter.

(Reporting by Dave McKinney and Karen Pierog; Editing by James Dalgleish)